Confidently pay your employees on time,

every time!

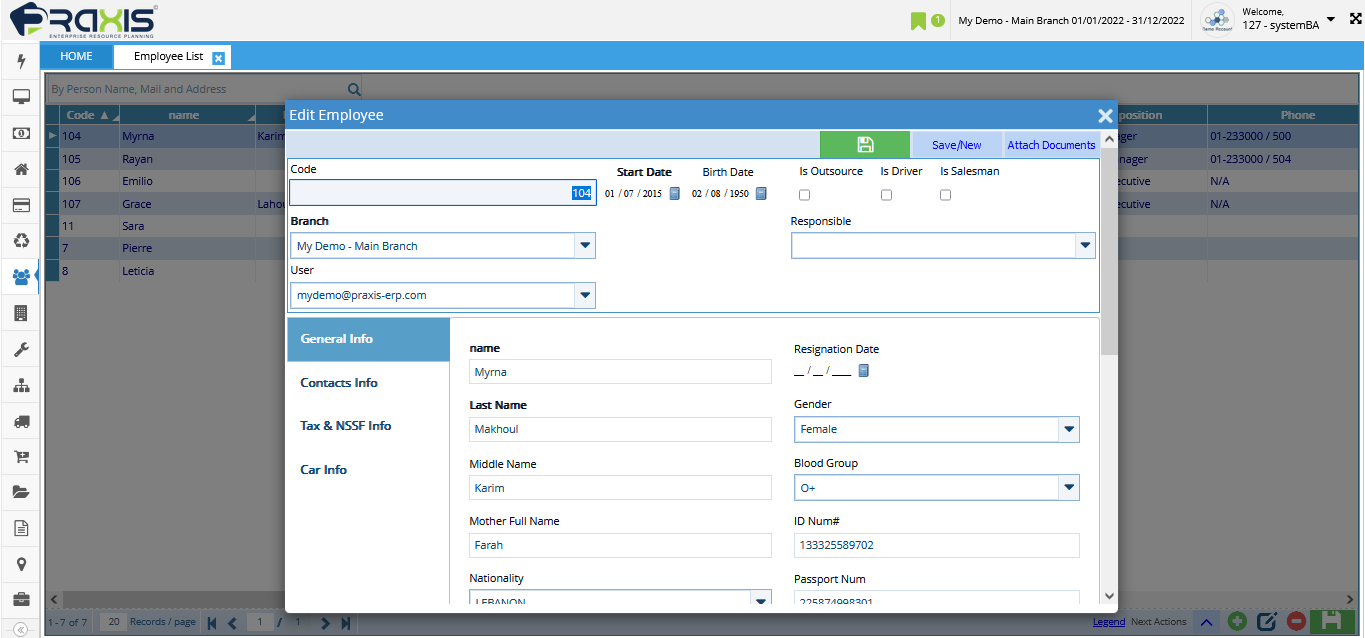

Manage your employee database and record all important personal (name, contact info, id), company-related (start date, position, department), accounting (account number, payment method), and Tax information (social security number, family status, effective date) in a centralized hub. Praxis ERP allows you to handle electronic filing, upload historical data, and store essential documents related to your workforce with the ability to instantly access and view data as needed.

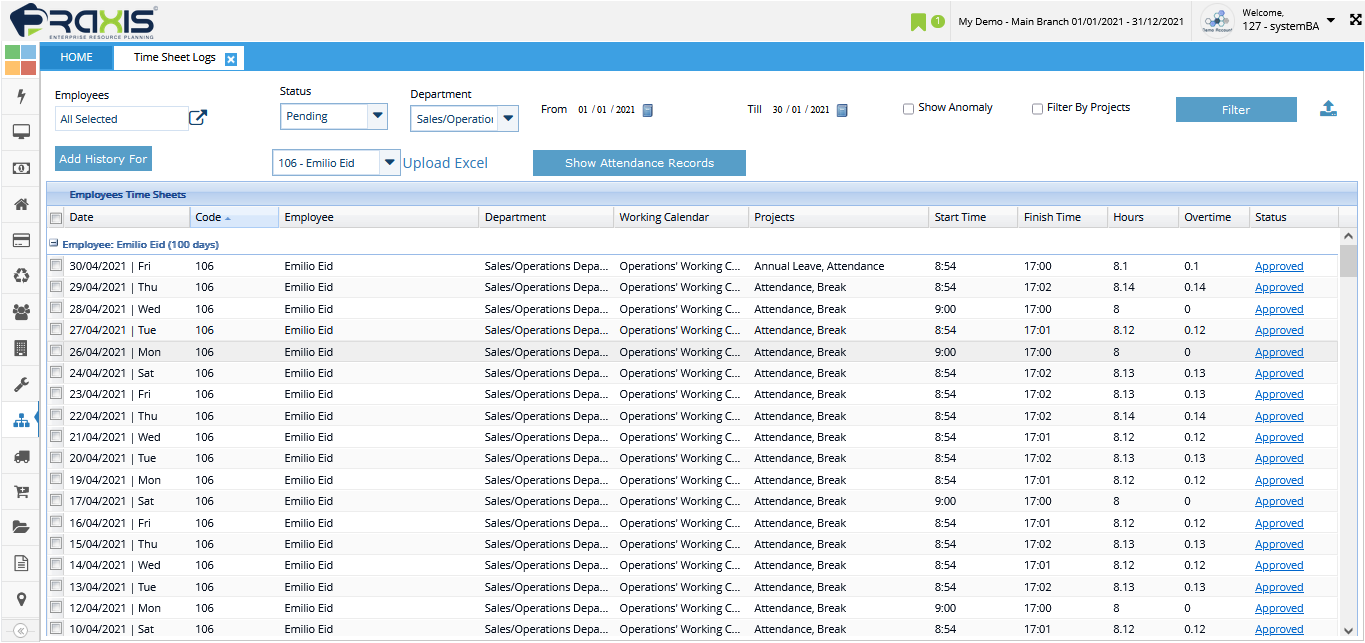

The Payroll module is integrated with the timesheet & attendance management which allows you to effectively monitor employee total hours worked based on clock-ins and outs and compare them against a predefined working calendar. You get to easily configure shifts as per your requirements in terms of default working days, shifts, schedule margins, and overtime among other things.

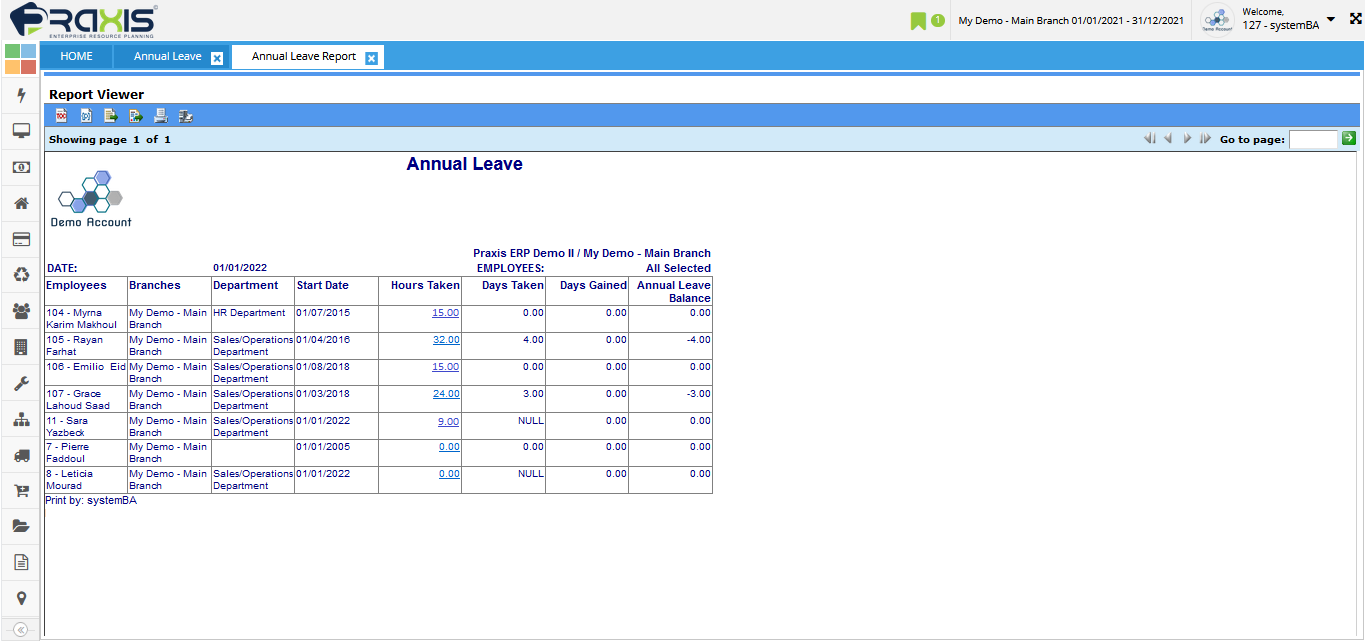

Praxis ERP carries out all functions related to leave management. Customize paid-time offs, vacation, and sick leave policies and get accurate time-off reports with just a few clicks — all while managing requests and keeping track of leave and sick balances at your fingertips!

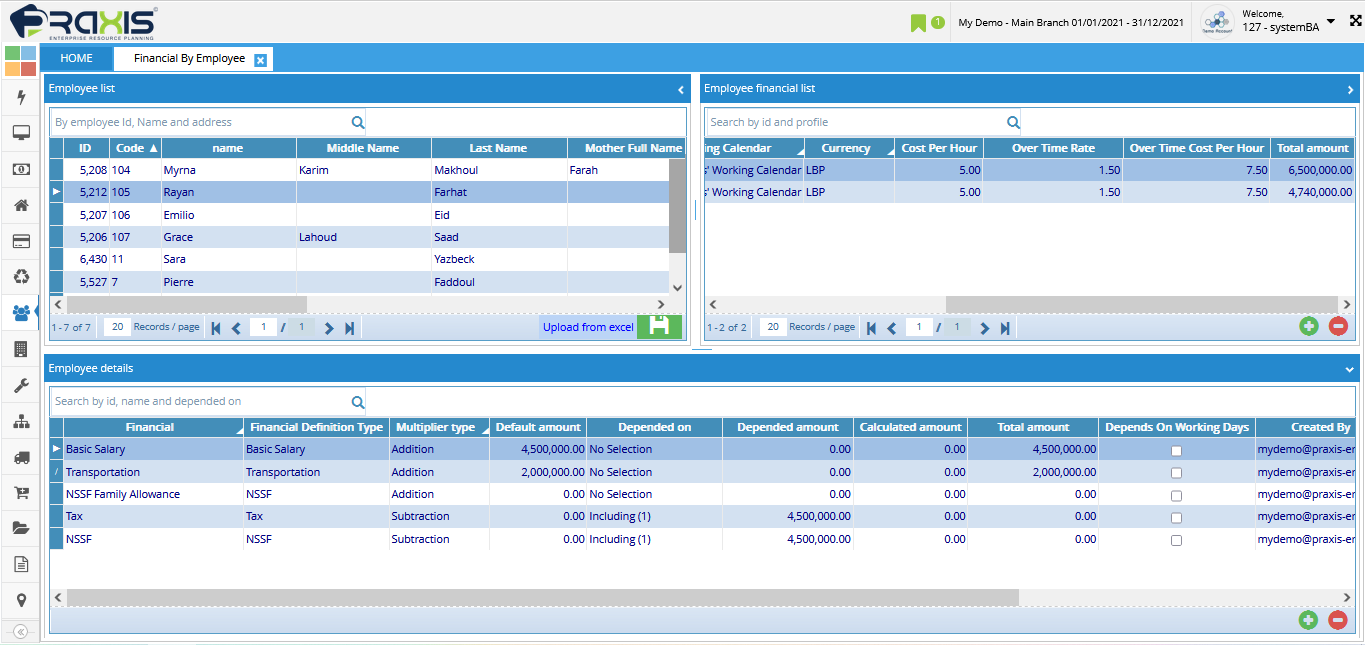

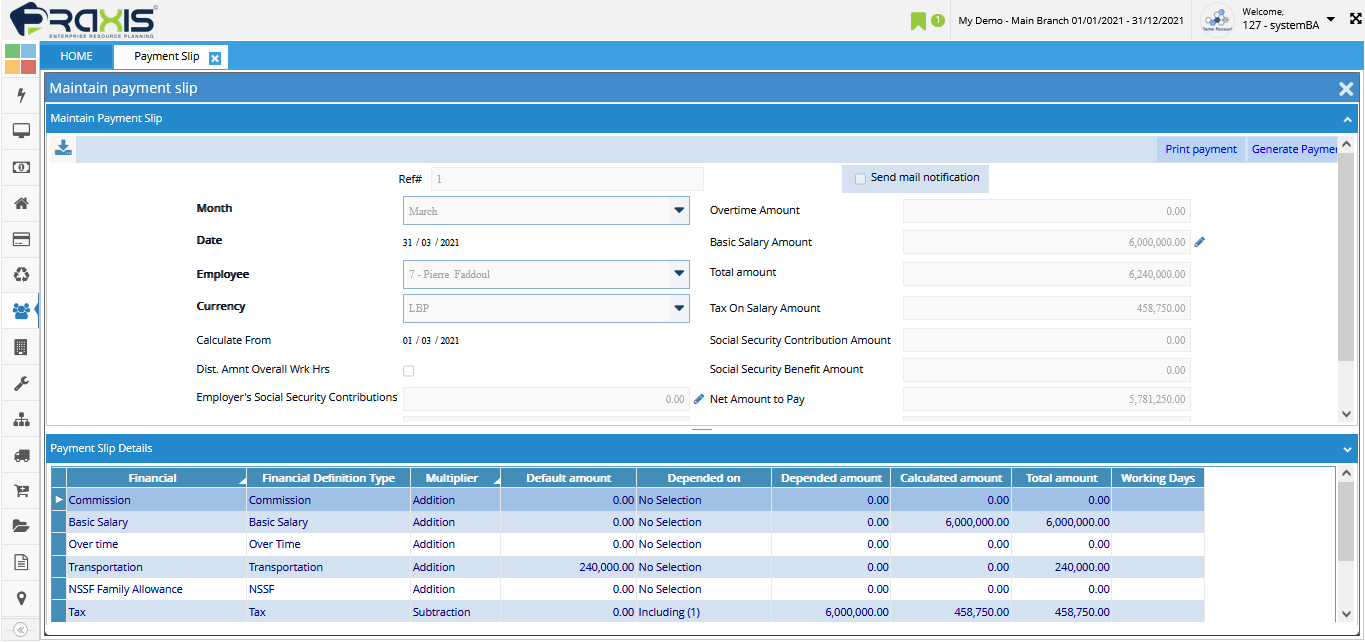

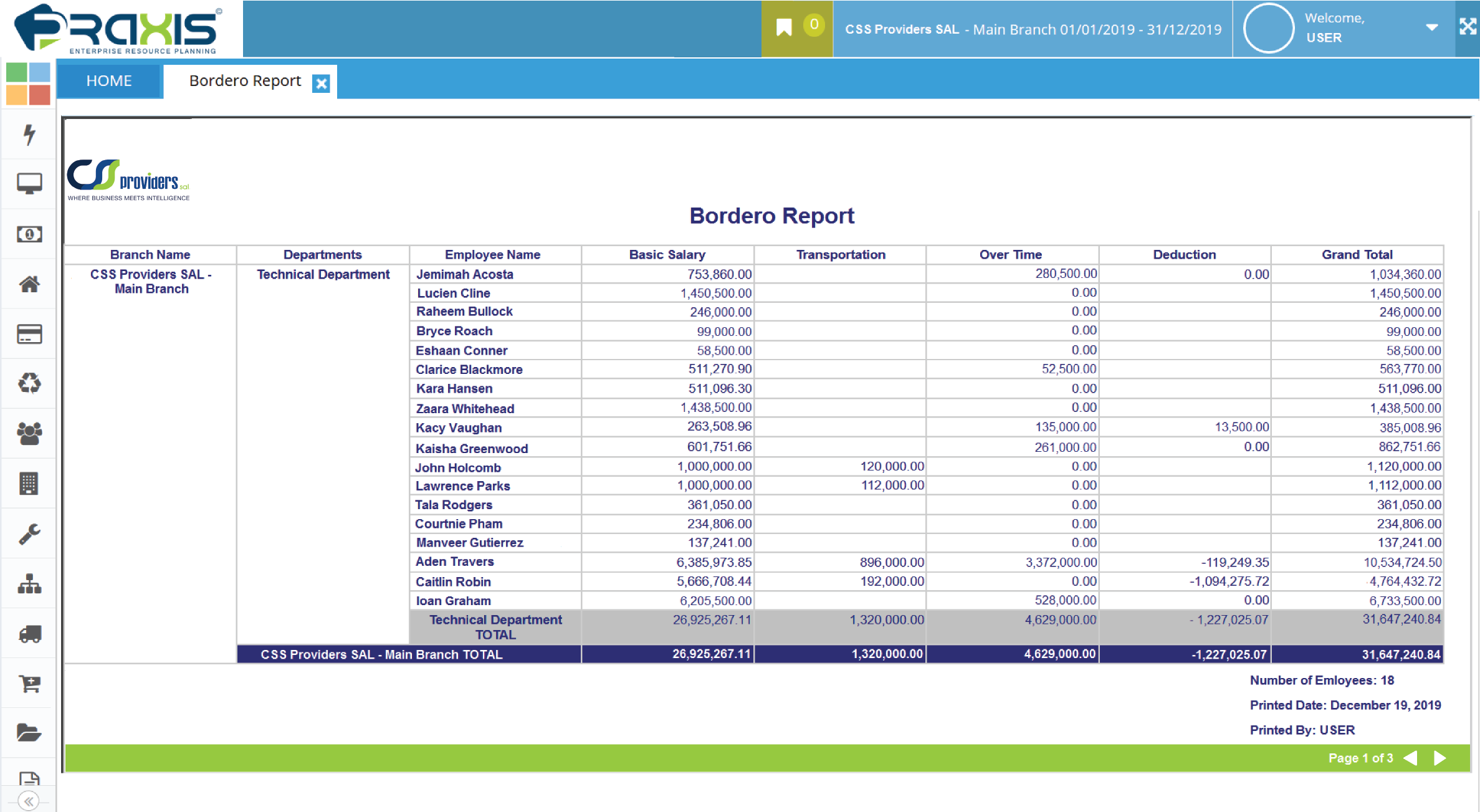

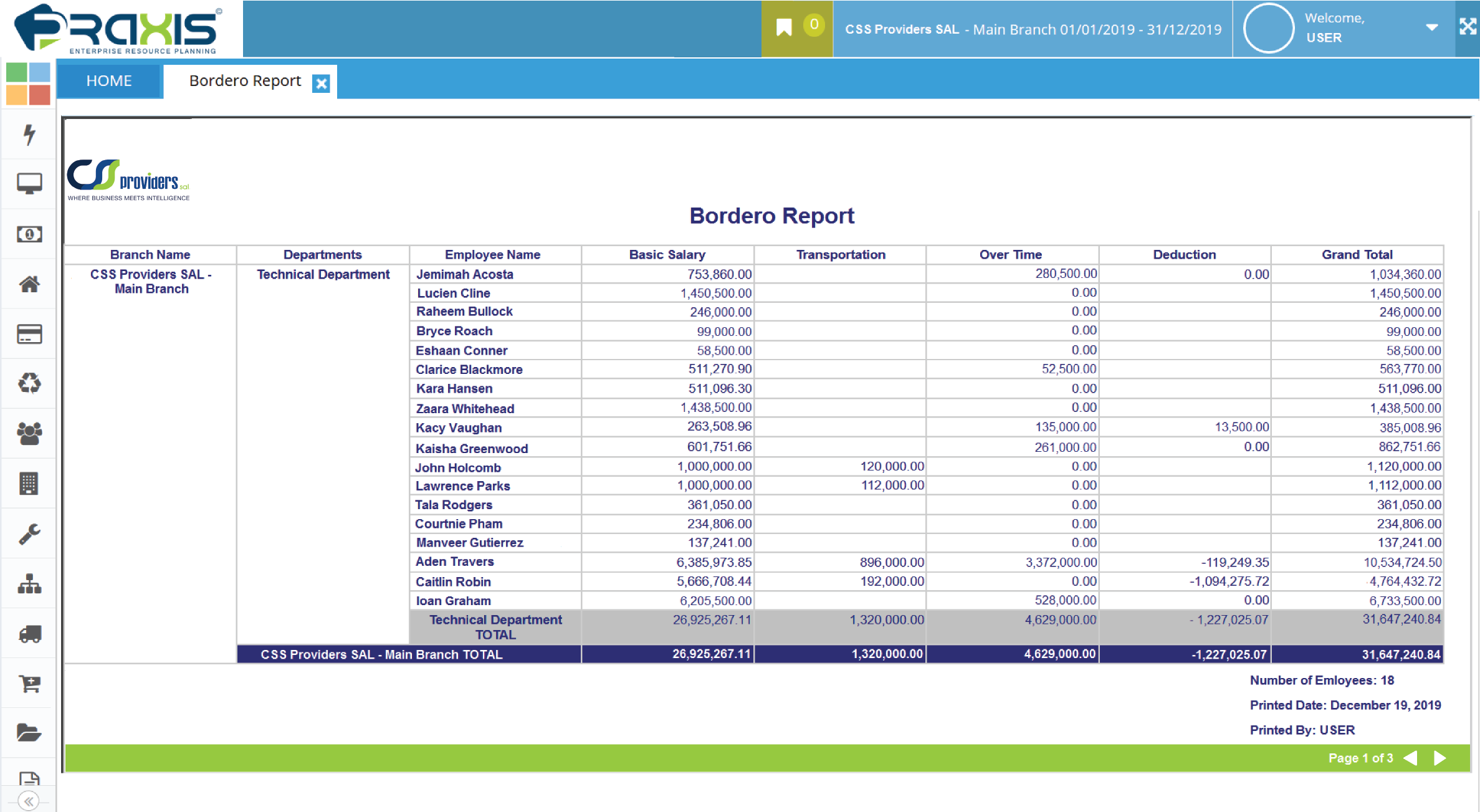

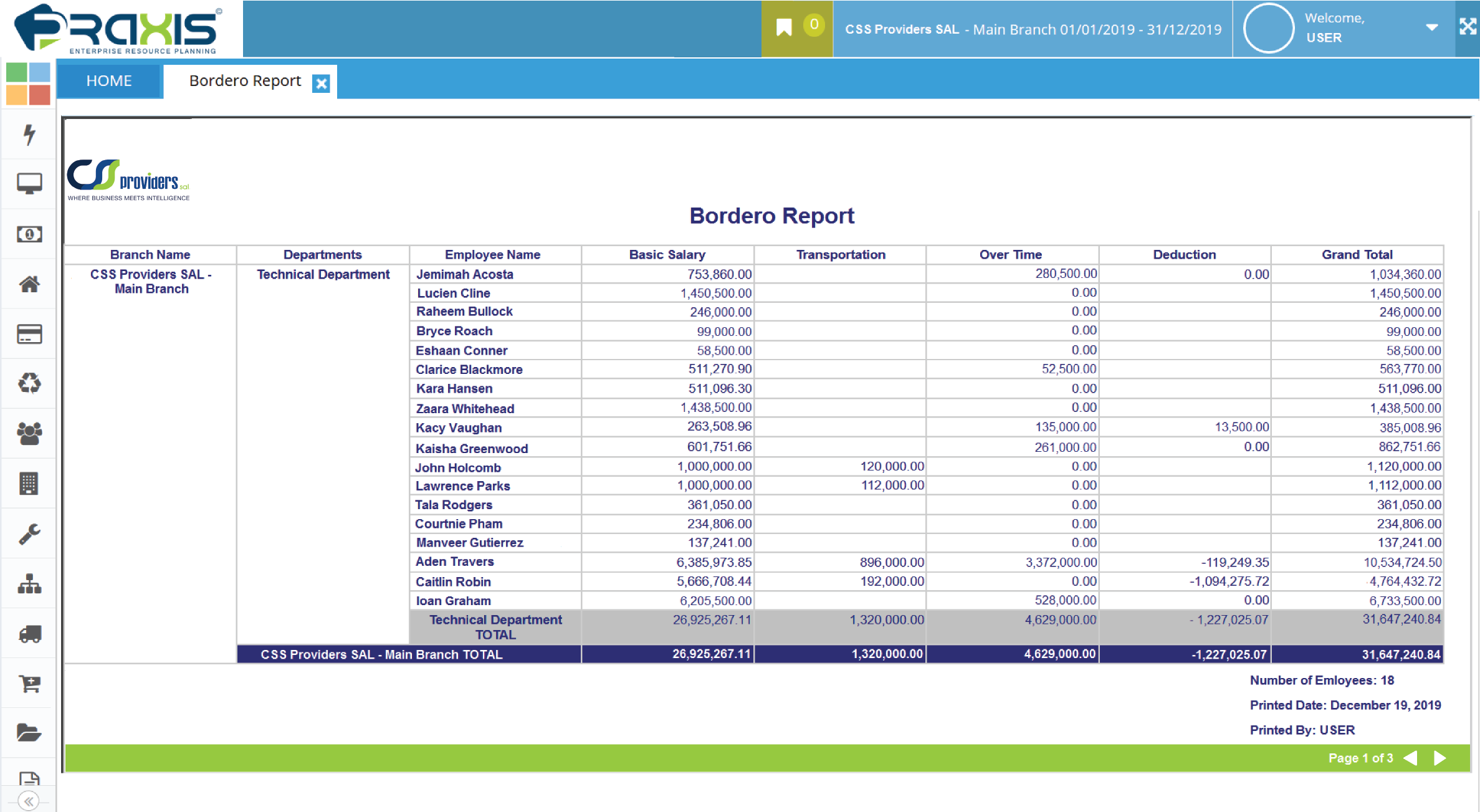

Praxis ERP simplifies and accelerates the way you do your payroll through flexible pay structures that can be tailored to every job function. Include, manage, and update variable payments, bonuses, commissions, deductions and other incentive compensation effortlessly. Once defined, this information flows automatically into payroll, so you can save time and reduce cost to process salaries.

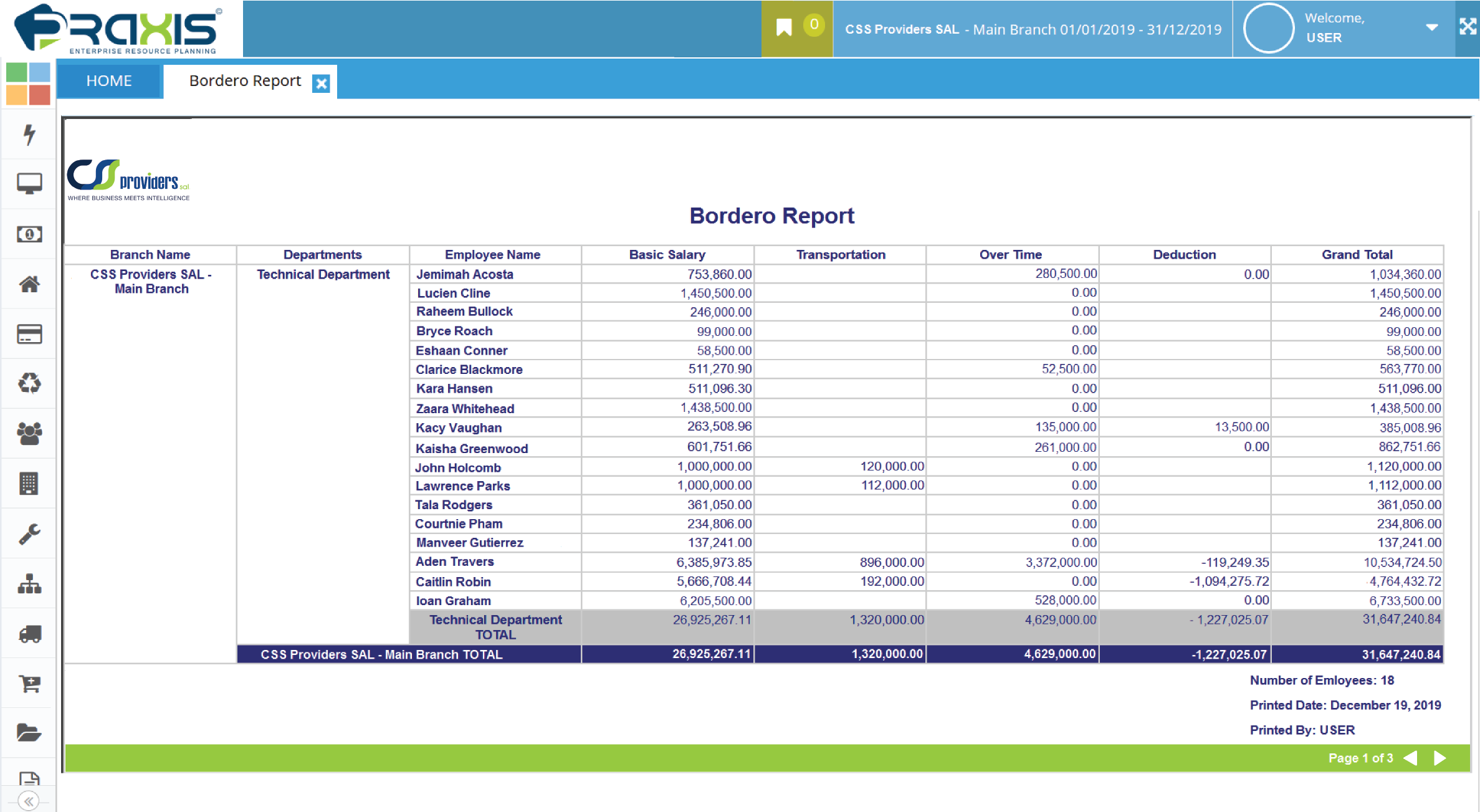

Praxis ERP’s payroll processing is accurate and error-free! You can instantly create and review payroll manually or in batches with the ability to customize payslip printouts, send email notifications, and issue payments with a click. Not to mention, the thorough breakdown of earnings and deductions.

Praxis ERP takes care of your workforce’s statutory forms and reports while eliminating the burden of filing and managing taxes. Using dynamic country-based configurations, automatically calculate taxes owed and paid per employee to meet all legal requirements and stay confident that your organization operates with enhanced compliance while keeping up with all regulatory changes.

Home

Home